Vancouver, March 6, 2023 - Nickel North Exploration Corp. (” Nickel North” or the “Company”) (TSX-V:NNX) is pleased to announce that the Company has entered into an option agreement (the “Option Agreement”) to sell a 100% undivided interest in the Hawk Ridge nickel/copper project (the “Hawk Ridge Project” or “Hawk Ridge”) located in northeastern Quebec to 1844 Resources (“EFF:TSXV), in exchange for a series of cash payments, share issuances and funding of exploration expenditures, separated into five phases.

CEO of Nickel North, Mr. Tony Guo, comments “This is a milestone transaction for Nickel North in partnering up with Mr. Laberge and team at 1844 in advancing Hawk Ridge in a world in drastic need for a quality North American nickel resource, especially one surrounded like Raglan and Voisey Bay Nickel Mines.”

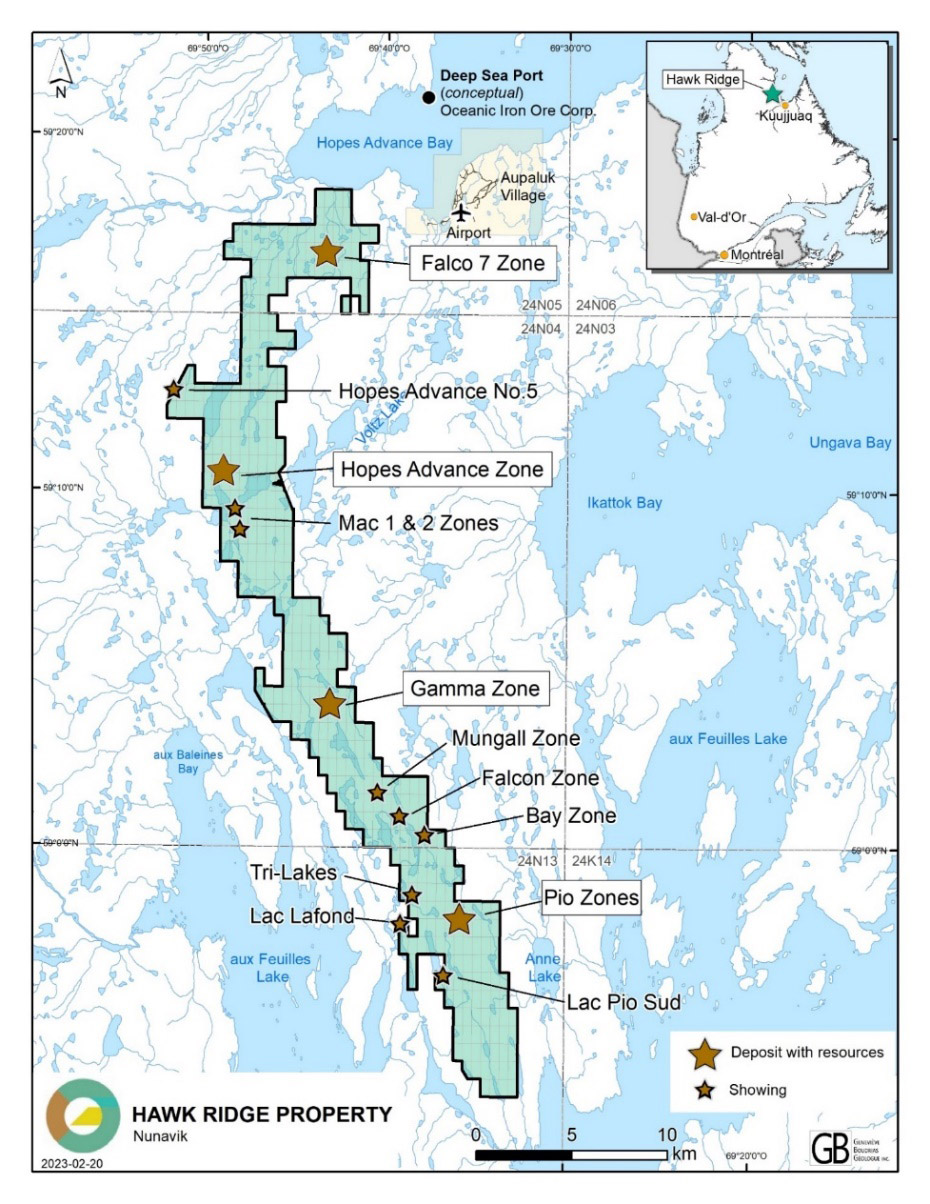

The Hawk Ridge Property

Hawk Ridge comprises of 411 claims covering 179 km2 over a 50km belt located on the Ungava Bay, located North of Kuujjuaq, with direct access to tidewater on the east coast of Quebec. The project is known for its Ni and Cu content, specifically:

- NNX completed mineral resource estimates for the Falco 7, Gamma, Hopes Advance Main and Hopes Advance North deposits. Metals included in the Mineral Resource estimate are copper, nickel, cobalt, platinum, palladium and gold. The aggregate pit constrained inferred mineral resource (the “Historical Resource”) for all four deposits as reported by NNX using a $35/t cut-off was 29.44 Mt grading 0.20% Ni, 0.52% Cu, 0.012% Co, 0.19 g/t Pd, 0.04 g/t Pt and 0.021 g/t Au, corresponding to 0.56% NiEq. 1844 is treating the Historical Resource as a historical estimate and not a current mineral resource. Please see “Historical Resource Estimate Notes” below for further information.

- The deposit contains an additional exploration target which was defined by NNX in its technical report titled “Technical Report and Updated Mineral Resource Estimate of the Hawk Ridge Nickel-Copper (PGE) Property, Northern Quebec, effective July 5, 2022 with a potential range of 35Mt to 60Mt with grades ranging from 0.35% to 0.40% Cu, 0.10% to 0.20% Ni, 0.01% to 0.02% Co, 0.03 g/t to 0.05 g/t Pt, 0.15 g/t to 0.20 g /t Pd and 0.03 g/t to 0.05 g/t Au. Exploration targets are based on estimated strike length, depth and width of known mineralization supported by intermittent drill holes, geophysical data and mineralized surface exposure observations. The potential tonnage and grade of this exploration target are conceptual in nature and there has been insufficient exploration to define a mineral resource. It is uncertain whether further exploration will result in the target being delineated as a mineral resource.

- The Hawk Ridge Property hosts disseminated mineralization, and subordinate lenses of massive sulphide that are hosted in porphyritic gabbro and olivine-rich gabbro. The sulphide minerals are mainly pyrrhotite, chalcopyrite, and pentlandite, with minor violarite and cobaltite.

- Localized concentrations of massive sulphides in gabbro and in remobilized sulphide mineralization in footwall metasedimentary rock found on Hawk Ridge, are associated with the presence of copper.

The majority of the Hawk Ridge Property is subject to a 3% net smelter return royalty (“NSR”), of which one third (i.e. 1%) may be repurchased at any time for $1,000,000. Another 1% of the NSR is subject to a right of first refusal.

Terms of the Option Agreement

Phase One

1844 is entitled to acquire a 10% undivided interest in Hawk Ridge on the date that is two business days following the approval of the Option Agreement (the “Effective Date”) by the TSX Venture Exchange (the “Exchange”) by paying $1,000,000 and issuing 1,000,000 common shares in the capital of the 1844 (“Common Shares”) to NNX (the “First Option”).

Phase Two

If 1844 exercises the First Option, it can acquire an additional 10% undivided interest in Hawk Ridge by paying $1,000,000 and issuing 1,000,000 Common Shares to NNX on the first anniversary of the Effective Date, and incurring $500,000 of exploration expenditures before the first anniversary of the Effective Date (the “Second Option”).

Phase Three

If 1844 exercises the Second Option, it can acquire an additional 20% undivided interest in Hawk Ridge by paying $1,000,000 and issuing 2,000,000 Common Shares to NNX on the second anniversary of the Effective Date, and incurring $500,000 of exploration expenditures before the second anniversary of the Effective Date (the “Third Option”).

Phase Four

If 1844 exercises the Third Option, it can acquire an additional 40% undivided interest in Hawk Ridge by paying $2,000,000 and issuing 3,000,000 Common Shares to NNX on the third anniversary of the Effective Date, and incurring $1,000,000 of exploration expenditures before the third anniversary of the Effective Date (the “Fourth Option”).

Phase Five

If 1844 exercises the Fourth Option, it can acquire an additional 20% undivided interest in Hawk Ridge by paying $1,000,000 and issuing 3,000,000 Common Shares to NNX on the fourth anniversary of the Effective Date, and incurring $1,000,000 of exploration expenditures before the fourth anniversary of the Effective Date (the “Fifth Option” and, collectively with the First Option, Second Option, Third Option and Fourth Option, the “Options”).

Any exploration expenditure relating to an Option incurred by the Optionee following the Effective Date but prior to the deemed date of grant of such Option will constitute a valid exploration expenditure for the purposes of the applicable exploration expenditure requirement of such Option. Any excess exploration expenditure incurred by the Optionee in connection with the Second Option, Third Option or Fourth Option will be carried forward and credited to the exploration expenditure requirements of subsequent Options.

The completion of the transaction is subject to several conditions, including, but not limited to, the approval of the Exchange and all other necessary approvals including shareholder approval by NNX shareholders for the Fourth and Fifth Options. Pursuant to the terms of the Option Agreement NNX is required to receive lock-up and support agreements from shareholders holding not less than 60% of NNX’s common shares.

Neither the Exchange nor its Regulations Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Qualified Person

The technical information in this news release has been reviewed and approved by Tony Guo, P.Geo., Nickel North Exploration Corp's President and CEO, who is a Qualified Person as defined by National Instrument 43-101.

About Nickel North Exploration

Nickel North Exploration is a Canada-based exploration company focused on defining a Cu-Ni-Co-PGE mineral resource at its Hawk Ridge Project in Northern Quebec. The board of directors, advisor committee and management team are experienced, successful mine finders. The property consists of a 50 km long belt of strong magmatic Cu-Ni-Co-PGE occurrences covering 179.67 km2. Quebec is a mining-friendly jurisdiction. Nickel North Exploration is a conscientious corporate citizen maintains good relations with local Inuit communities and is committed to sustainable development. For more information on the company, please visit www.nnexploration.com or follow Company on Twitter at https://twitter.com/nickelnorth.

Nickel North Exploration Corp. has been identified as a key player in the Critical and Strategic Minerals value chain by Quebec's Ministry of Economics and Innovation (MEI) in 2021 (Quebec Plan for the Development of Critical and Strategic Minerals 2020-2025 (quebec.ca), which is part of Quebec's Plan for the Development of Critical and Strategic Metals (QPDCSM) and aims to stimulate the exploration and mining of SCMs, their transformation and recycling.

Per: "Tony Guo"

Tony Guo

Nickel North Exploration Inc.

Tony Guo. P. Geo, Chief Executive Officer (Tel: +1-778-877-5480)

E-mail: tonyguo@nnexploration.com

North America IR / PR Jemini Capital

Jorge Galindo jorge@jeminicapital.com

Tel: +1 (647) 725-3888 x703

For further information please visit http://www.nnexploration.com

This news release may contain forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release may include, but is not limited to, the Company's objectives, goals or future plans. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, those risks set out in the Company's public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames, or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. Neither TSX Venture exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The securities being offered have not been, nor will they be registered under the United States Securities Act of 1933, as amended, or state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent U.S. federal and state registration or an applicable exemption from the U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.